Lee el artículo «Empowerment Begins With Identity. How digital identification enables women’s financial inclusion» escrito por nuestra investigadora principal, Carolina Trivelli , junto a Benno Ndulu para el Portal FinDev ► https://bit.ly/3aGVlfe

Artículo en español ►https://bit.ly/3cCiJw2

Woman with ID card. Photo by Daniel Silva Yoshisato/World Bank

Opening a bank account in many countries is a difficult process that requires numerous different official documents. As a result, many poor people, especially women, have little choice but to gravitate towards the informal economy. But this need not be the case. Identification (ID) systems supported by digital technologies can enable people to prove who they are at the touch of a scanner or scan of a QR code, making the account opening process and other financial transactions much faster and simpler.

Several countries are already harnessing the potential of digital ID systems to transform the lives of women. For example, India leveraged biometric technology to provide a unique identification number to over 1.2 billion people and to streamline the identity verification process for account opening. These efforts helped reduce the gender gap in account ownership from 20 percentage points in 2014 to 6 percentage points by 2017.

Lack of official identification is a barrier to financial inclusion

The 2017 Global Findex survey estimates that 1.7 billion people around the world – 980 million of whom are women – are unbanked. Of these, one-fifth say they don’t have the documentation needed to open a bank account. Lack of a trusted proof of identity is a big part of the documentation barrier. A recent survey of financial sector authorities across 124 jurisdictions shows that a government-issued ID is required in 90 percent of jurisdictions for account opening by commercial banks. Moreover, as many ID systems are limited in their coverage and robustness, FSPs struggling to verify customer identities will often require added documentation or else take on higher risk, driving up the cost of financial products and services.

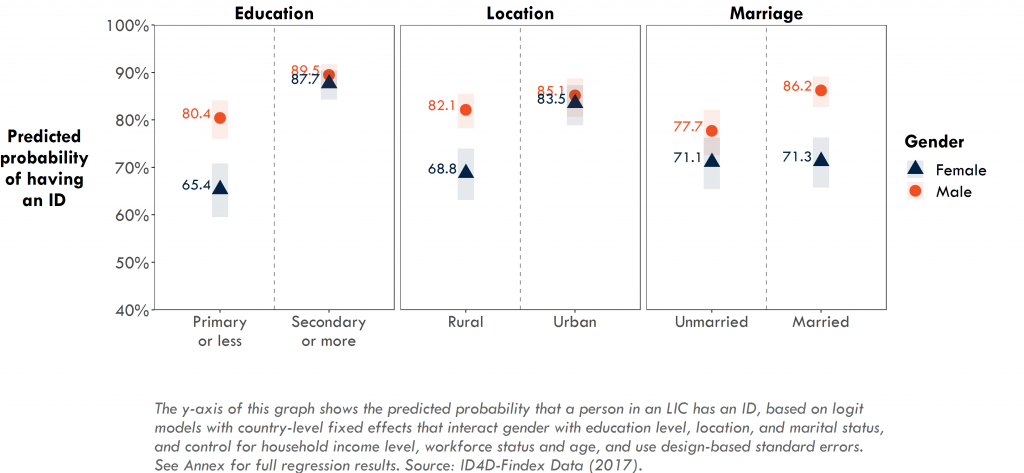

Lack of official identification thus represents a significant barrier to financial inclusion for the poor, particularly women. As many as 1 billion people worldwide still struggle to prove who they are. And in low-income countries (LICs), 44 percent of women do not have an ID, with lower-educated women and those living in rural areas being particularly likely to struggle to prove who they are (Figure 1).

FIGURE 1. PROBABILITY OF HAVING AN ID IN LICS: DIFFERENCES FOR MEN AND WOMEN.

Gender-specific obstacles that women may face in obtaining an ID include:

- Legal barriers, for example, the requirement to have a male guardian or husband present to register.

- Procedural barriers, for example, the requirement for married women – unlike men – to provide proof of marital status to obtain an ID.

- Economic barriers, for example, lack of funds to cover transport costs to an enrollment center.

- Social barriers, for example, restrictions on women’s freedom to travel outside their home or community.

Digital ID systems can help women access financial services

Addressing these barriers lies at the core of the World Bank’s Identification for Development (ID4D) Initiative. ID4D is currently supporting more than 40 countries to design and implement inclusive and trusted digital ID and civil registration systems, in collaboration with other development partners. With ID4D’s support, countries are modernizing their legal frameworks to streamline registration and to strengthen privacy safeguards, bringing ID enrollment closer to women’s homes, and adopting new identity verification and authentication technologies to make it easier for women to use their IDs to access financial services.

Many countries have already made great strides in using digital ID systems to empower women. In Pakistan, for example, millions of women now possess a Computerized National Identity Card (CNIC), which allows them, rather than their husbands or brothers, to access government income support programs. And in Uganda, making national IDs more easily accessible to all has enabled small-scale traders, the majority of whom are women, to verify their identities more easily when crossing borders and accessing financial services, boosting business opportunities and incomes.

Digital technologies also offer a lot of room for innovation at the nexus of identification and financial inclusion. Peru’s BiM (Billetera Movil) provides a powerful example. Close to 60 percent of people – and 65 percent of women – in Peru lack a financial account, limiting economic opportunities for many and making it more difficult to administer government cash transfers in a secure and cost-efficient way. In response, a group of Peru’s largest financial institutions and telecom companies came together in 2015 to create BiM, a mobile e-wallet that allows users to receive and transfer funds digitally, including to pay bills, taxes, and school fees.

With near universal ID coverage today, Peruvians can open a BiM account using only their mobile phone number and their unique ID number. Verification of the e-wallet can be done digitally in a few minutes and allows transactions to occur in real time. Women entrepreneurs like Maria, who runs a convenience store in Lima, now use BiM to pay suppliers and take payments from customers. “I no longer have cash in hand. My cash is in the e-wallet. Thieves can take my phone but not my money.”

Maria benefits from BIM at home and in running her business. Photo by Daniel Silva Yoshisato/World Bank

Although there is still much more to be done, there is significant momentum across government, development partners, and the private sector to close ID coverage gaps and use digital ID systems as platforms to facilitate financial inclusion and digital payments. Together, we can empower women to fully participate in society and the economy.

About this post

Carolina Trivelli is an Economist, Senior Researcher at Instituto de Estudios Peruanos and former Minister of Development and Social Inclusion in Perú.

Benno Ndulu, former Governor of the Bank of Tanzania is Mwalimu Nyerere Chair Professor at the University of Dar es Salaam and Visiting Professor Blavatnik School at the University of Oxford. Ms. Trivelli and Mr. Ndulu serve on the Identification for Development (ID4D) Initiative High-level Advisory Council.